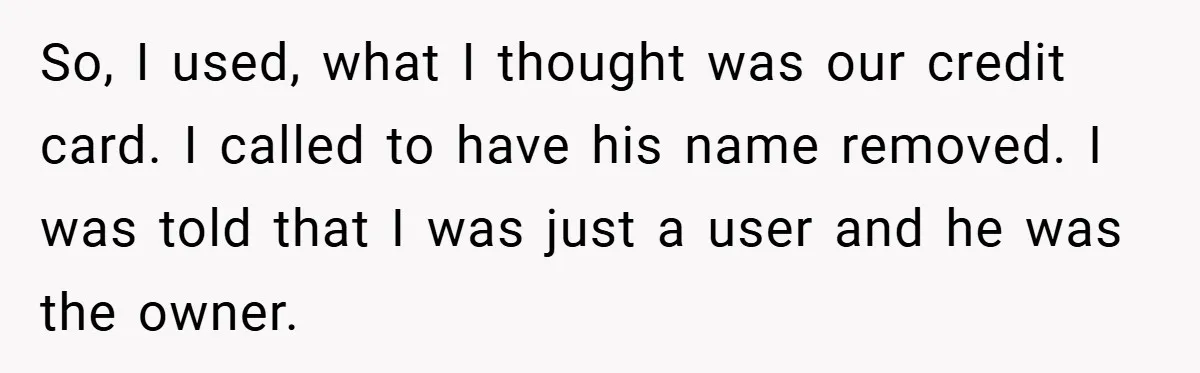

Losing a loved one is already painful, but nothing adds insult like dealing with unfeeling bureaucracy right after. This woman thought she and her husband shared a credit card until she used it for his funeral and learned that legally, it wasn’t “hers” at all.

The bank refused to transfer ownership, leaving her stuck in limbo. But months passed and no one ever came knocking. The debt just… disappeared. And that’s how, through a strange twist of corporate oversight, her husband ended up paying for his own final farewell.

A widow tries to settle her late husband’s funeral bill and ends up discovering an unintentional “final gift”

This story sheds light on a surprisingly complex and often overlooked issue: how debt, especially credit card debt, is handled after death. While it may sound like a small bureaucratic quirk, credit card ownership rules can have major financial and emotional consequences for surviving spouses.

In the United States, credit card accounts are legally tied to the primary cardholder, not the authorized user. According to the Consumer Financial Protection Bureau (CFPB), authorized users are not liable for any debt on an account unless they are co-signers or joint account holders.

That means in this woman’s case, the bill for her husband’s funeral technically fell under her late husband’s estate, not her personal responsibility.

When someone dies, the estate (which includes assets like savings, property, and investments) becomes responsible for paying outstanding debts. If the estate has insufficient funds, the debts often go unpaid, and creditors must write them off.

As attorney and estate law specialist Patrick Simasko explains, “creditors can’t come after a surviving spouse for debts that were solely in the deceased person’s name unless the state follows community property laws or the spouse co-signed the credit agreement.”

For anyone facing a similar situation, it’s crucial to notify creditors in writing and provide a copy of the death certificate. Many banks have dedicated probate departments, as one Reddit commenter who works in banking pointed out.

They handle estate-related accounts, ensuring that liability is assigned properly. Attempting to assume ownership of a deceased person’s account without authorization can create legal complications, especially if the creditor refuses to transfer it.

This story also highlights the emotional toll of navigating corporate systems during grief. The CFPB has noted that surviving family members often report harassment or misinformation from debt collectors.

Under the Fair Debt Collection Practices Act, collectors are prohibited from implying personal responsibility for a loved one’s debt if it doesn’t legally exist.

These are the responses from Reddit users:

One user suggested throwing the “authorized user” excuse back at the bank if they chase you, noting they’d need to sue the estate

Another shared a frustrating tale of a funeral home denying pre-paid arrangements

While this commenter explained PNC’s strict authorized-user rules as anti-abuse measures

This group vented about funeral and credit card company greed, with the latter facing similar post-death runarounds

This folk urged checking your credit report, sharing their own Citibank fiasco

While this couple recounted battles with creditors who ignored death notifications

This Redditor praised pre-planning, contrasting your chaos

The story shines a light on how unkind financial bureaucracy can be to grieving families, but also how sometimes, through error or oversight, life offers small mercies.

Would you have fought to pay the bill for closure, or let the system’s indifference settle the score? Either way, this tale proves one thing: even death can’t escape paperwork, but sometimes, paperwork forgets to fight back.