A family landmark turned into a financial minefield, and nobody’s walking away clean.

A dad who says he isn’t “rich” (earning over $200,000 a year, by his own admission) decides to help his kids buy houses. One child gets a deal: father lends money for a down payment in exchange for equity. The other child balks, labels him [the jerk], and walks away into a condo on her own.

The core: a parent wants to offer help, but treats one child like a business partner and expects a return. The other sees it as favoritism and unfair terms. Torn feelings, sibling rivalry and wealth-transfer anxieties crash into each other.

Now, read the full story:

My heart goes out to everyone here. The parent is trying to help, but the pattern he chose landed him in a sibling schism. The daughter feels the contract is exploitative and unequal; the son accepted the deal. The parent is balancing generous support with business logic. This mix creates confusion and hurt.

Often when money and family mix, boundaries blur and resentment creeps in. This feeling of isolation and unfairness is textbook in many family business-finance conflicts.

At its core this story involves three tangled dynamics: inter-generational wealth transfer, sibling equity/fairness, and the financial-relationship boundary between parent and grown child.

One clear fact: many parents and adult children are using family money to get into homes. For example, research shows roughly 30 % of first-time buyers received direct parental help with a down payment.

Also a survey found 25 % of recent buyers with kids got cash gifts from family for down payments, versus 12 % for buyers without kids.

So the parent is not doing something unheard of financially. But the terms and fairness between siblings are where trouble begins.

A psychology from Psychology Today take: financial help from parents is “particularly divisive.” Money and values collide. One parent-finance coach writes: “There is nothing like money to spark family feuds and emotional divides.”

Legally and practically: A legal-finance article explains that whether funds are a gift or a loan/investment must be clear and documented. If one child gets equity deal and another doesn’t, complications (tax-, inheritance-, sibling- disputes) can follow.

You offered one child a purely financial deal (you invest for equity) and the other you refused that deal (or offered something different). From your daughter’s view: you “helped” her brother but made her go it alone. That invites feelings of favoritism, inequality, and resentment.

From your son’s view: he accepted terms and you supported him financially. So his path is smoother.

So the fairness equation is off. Also the “help” is partly business rather than unconditional family support. That changes the parent-child dynamic. And it opens risk of emotional cost, as the expert warns.

Actionable insights

-

Define “help” vs “investment” clearly: If your offer is business terms, call it that. If you intend to treat it like family help, you might consider a simpler gift or interest-free loan. Experts insist on documenting.

-

Ensure sibling fairness—to the extent possible: If you help one child, have a plan for how you view helping the other (either now or later) so that resentment doesn’t brew. The “equity” in your relationship matters.

-

Be transparent about risks and roles: If you hold 25 % of the house equity, you are co-owner. That implies sharing in maintenance, costs, taxes, decisions. Make sure your children understand and accept that.

-

Protect your retirement & own finances: As one expert cautions, parents who overextend risk their own independence or financial security.

-

Document the deal and boundary lines: If this becomes a formal investment arrangement, use loan agreements or co-ownership contracts. If you just want to gift or support, write that down and keep terms simple. Legal clarity prevents future fights.

What your story really shows is this: helping your children buy homes is laudable, but how you help changes everything. A generous parent offering an investment deal is very different from a parent offering unconditional support.

When one child is treated as co-investor and the other is told “figure it out yourself,” sibling rivalry and resentments are invited. Fairness, clarity, and communication are the tools that can avoid turning a family support moment into a family fracture.

Check out how the community responded:

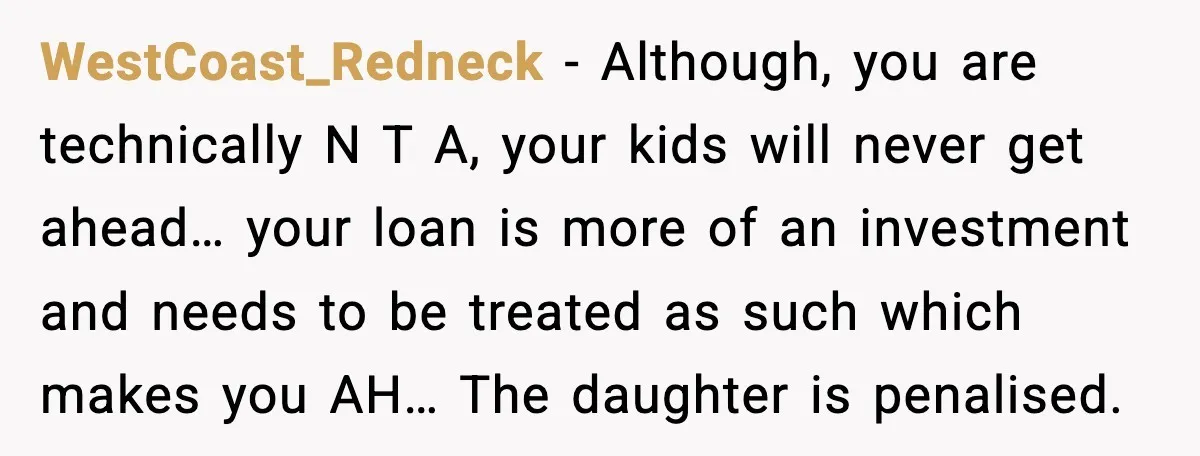

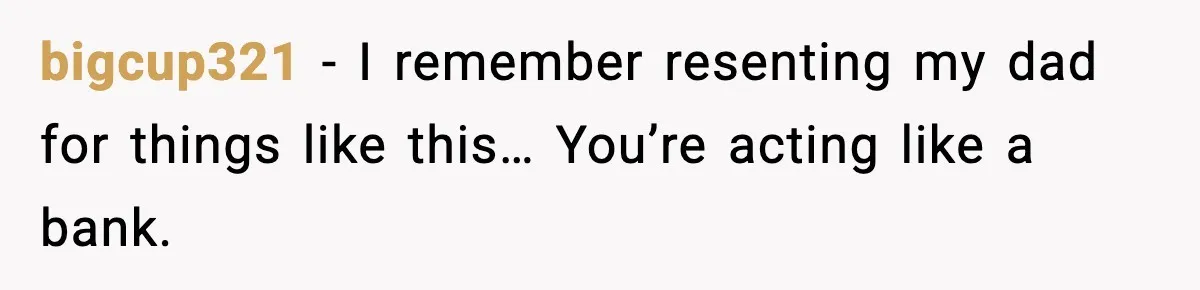

This group flagged the equity-deal as essentially using children as investment vehicles rather than offering support.

These comments highlight how differential treatment of daughter vs son breeds resentment.

![Dad Turns His Kids’ Home-Loans into Real-Estate Investments. Is He Wrong? [Reddit User] - INFO In what sense is this a loan? It sounds like you are co-owner.](https://dailyhighlight.com/wp-content/uploads/2025/11/wp-editor-1763633074040-3.webp)

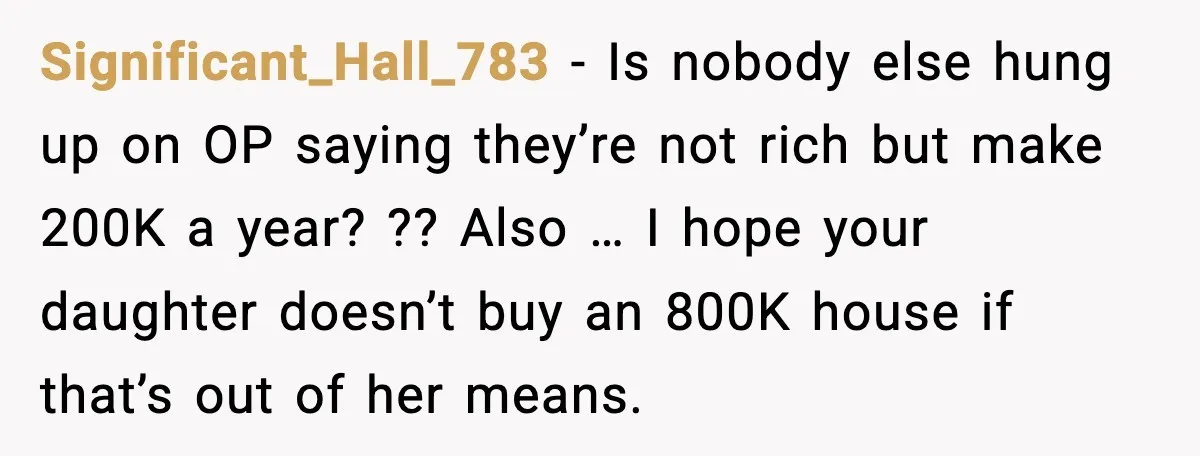

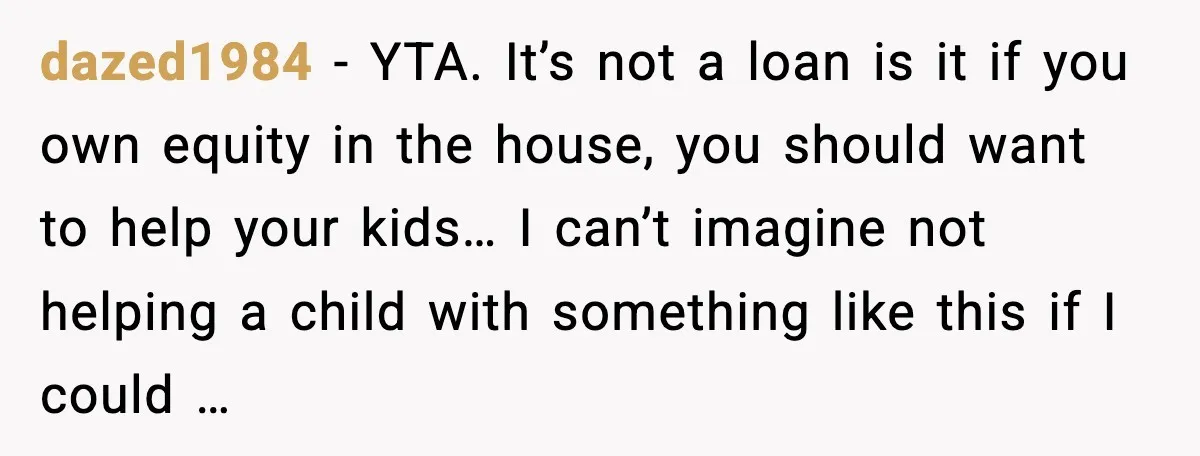

Here commenters look at the broader trend and risks of helping adult children financially.

![Dad Turns His Kids’ Home-Loans into Real-Estate Investments. Is He Wrong? [Reddit User] - I feel like we’re missing a lot of info that you purposefully omitted, but … you really suck dude.](https://dailyhighlight.com/wp-content/uploads/2025/11/wp-editor-1763633042202-2.webp)

The intention to help your kids step into homeownership is admirable. But your method—treating one child’s “help” as an investment while the other is left to buy a condo—opened emotional, relational, and fairness landmines. Helping isn’t automatic good; how you help matters.

Could you have offered both children the same deal—or offered one an unconditional gift or no strings attached support? Maybe.

What do you think? Is the father completely in the wrong here, or was he simply applying logical terms to his own money? Could he salvage the relationship now with the daughter—what might that look like?

Your turn: What would you advise this parent to do next?

It keeps saying the children were each offered a different deal, which isn’t what he said. He offered the same deal, the son took it and the daughter refused. It is not a bad deal as he gets no return on his investment unless they sell up, (unless he’s demanding rent). It’s not overly generous, but not terrible.